“I understand VIPR are talking to companies in the Australian market. As an ACORD member and working closing with our solutions group, I would be happy to talk to any prospect you may be working with

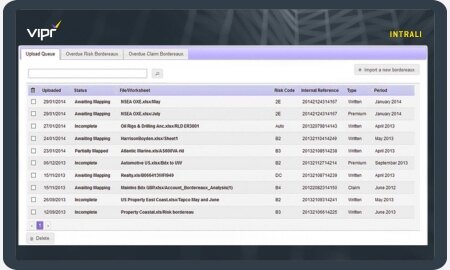

VIPR INTRALI

BORDEREAUX MANAGEMENT

VIPR Intrali is a market-leading bordereaux management solution, validating, transforming and aggregating risk, premium and claims data into a single, trusted data model.

VIPR’s bordereaux management system standardises large amounts of bordereau data, importing and converting multiple data formats to a single data standard.

As well as cleansing the data, the system uses hundreds of checks and validations on the imported data referring to the binder terms and previously processed data. The software's sophisticated capabilities enhance the collected data, delivering more comprehensive information. All this is underpinned by an intuitive and familiar user interface that makes VIPR Intrali quick and simple to use.

When coupled with the VIPR Portal and VIPR Data Cloud, you have an API-enabled data pipeline with straight-through processing capabilities, reducing your team's workload and freeing them up for more productive tasks.

And, once you have a clean, standardised set of bordereau data you can rely on, VIPR Insights gives you the information you need to make informed decisions, driving underwriting performance improvements.

Why use VIPR Intrali for bordereaux management?

- Accelerate your data processing, increasing operational efficiency

- Check and validate data ensuring your partners are complying with their agreed contact terms

- Intuitive user interface empowers business users and reducing reliance on internal IT teams

- Drive underwriting improvements using trusted data

Case studies

-

-

-

With the introduction of new regulations by Lloyd’s, Advent recognised the need to understand the data they were receiving through bordereaux cleansing, validations and accurate reports. They also fel

-

“The implementation of Intarga, Intrali and Active Reports has enabled us to move from a paper driven process to an electronic solution within required timescales set-out at the start of the project.

-

Why choose VIPR? For Business Process As A Service (BPaaS)

-

Meridian Risk Solutions Ltd is a fully accredited independent Lloyd’s Broker, specialising in Marine, Hull, Cargo, Protection and Indemnity, Kidnap and Ransom, Energy, Property, Casualty, Delegated Un

-

-

MGAM selects VIPR’s Intarga alongside Intrali, Active Reports and Insurance Broking Accounts solutions to build processes that ensure excellent customer service

-

During 2018 Channel had created a new vision for effective bordereaux management and adjusted its model for data receipt, quality, reporting and analytics.

-

-

Oneglobal selects VIPR’s Intrali, Active Reports and VMS to accelerate renewals and data management

-

Why choose VIPR? Setting up a new business is never easy, but making the right decisions from the start, sets you up for success!

-

Why choose VIPR? To gain progressive, effective and efficient data insights.

-

Why choose VIPR? For best-in-class technology to accelerate new Canadian branch!

-

Why choose VIPR? Forward thinking data management, with future plans to seamlessly integrate data from bordereaux to real-time downstream data exchange through API flows

-

Specialty (re)insurer partners with VIPR to enhance data-driven decision-making through advanced technology and automation, revolutionizing their underwriting and reporting processes.

-

Why choose VIPR? To ensure you have a long-term partner to accelerate your business growth plans.

-

Streamline onboarding and due diligence in insurance with VIPR's Intarga, enhancing efficiency, security, and compliance for a seamless data management experience.

-

Why choose VIPR? To seamless fusion of Reinsurance, Blockchain Technology, and Alternative Capital Resources

-

Why choose VIPR? For platform compatibility. Effective platforms don’t operate in isolation.