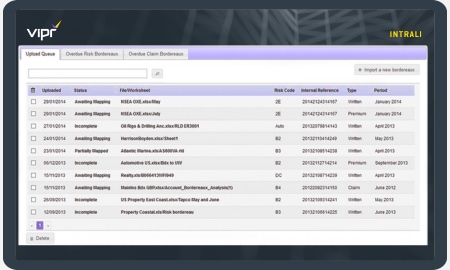

VIPR Intrali

Bordereaux Management

VIPR’s bordereaux management system standardises standardizes large amounts of bordereau data, importing and converting multiple data formats to a single data standard.

As well as cleansing the data, the system uses hundreds of checks and validations on the imported data referring to the binder program terms and previously processed data. The software's sophisticated capabilities enhance the collected data, delivering more comprehensive information. All this is underpinned by an intuitive and familiar user interface that makes VIPR Intrali quick and simple to use.

When coupled with the VIPR Portal and VIPR Data Cloud, you have an API-enabled data pipeline with straight-through processing capabilities, reducing your team's workload and freeing them up for more productive tasks.

And, once you have a clean, standardised standardized set of bordereau data you can rely on, VIPR Insights gives you the information you need to make informed decisions, driving underwriting performance improvements.

Accelerate your data processing, increasing operational efficiency

Check and validate data ensuring your partners are complying with their agreed contact terms

- Intuitive user interface empowers business users and reducing reliance on internal IT teams

- Drive underwriting improvements using trusted data